Tree Farm Tax Deductions

Yes there are tax deductions but I believe its at the time of harvest. Costs to establish and tend a tree plantation including costs of seedlings and plants expenses which relate to the.

Making A Seasonal Business Profitable Year Round Mybusiness

Christmas tree farms do not qualify for the reforestation tax credit.

Tree farm tax deductions. In other words those preproductive costs such as fertilizer and labor can be immediately expensed. Under current federal law the deduction is limited to 30 of your adjusted gross income and any amount you cant use one year can be carried forward and used over the next five years. On the bright side Revenue Ruling 71-228 clarifies that pruning and shearing costs are currently deductible business expenses not capital expenditures.

Generally you should include these expenses on your Schedule F form. Tree Farm Program Learn more about North Carolinas Present Use Value tax program and other tax tips for woodland owners. The balance of 3000 can be carried over for deduction on their 2004 tax return.

The trees that a farmer sells are taxed at capital gains rates if they are held for a minimum of 12. Deducting current expenses is relatively straightforward. Tree Farm Tax Tips Capital Gains Tax.

More Information on Taxes NC. Tax Write-Offs for a Tree Farm Exploring Labor Expenses. Homestead and Small Farm Tax Deductions If you manage a homestead or small farm this short article has some ideas for farm tax deductions you could claim.

Capital Gains Tax Breaks. If a tree. The Smiths planted fast-growing hybrid poplar trees for timber production.

Costs of seedlings and plants expenses which relate to the planting process such as deep ripping mound ploughing. Together with our partners we work to ensure our Tree Farmers have the tools that they need when they need them. Once qualifying purchases reached a threshold of 2550000 in 2019 the amount of the deduction was reduced dollar-for-dollar for each dollar above the threshold.

If your conservation easement meets certain requirements it can qualify as a tax-deductible charitable donationand that can translate into significant state and federal income tax savings. Important to the tax implications is the age of the trees. On their 2003 return the Blacks can deduct only 15000 as a soil and water conservation expense because the maximum deduction is 25 percent of gross income from farming.

One of the potential tax breaks available to tree farm owners is that sales of trees. Instead growers capitalize planting costs and add them to their plantation account then recover them as they harvest the trees for sale. You can accrue your costs against your income at harvest time.

You can deduct the following expenses when you incur them. If youre looking at reducing your income tax by things you do on your forest on a yearly basis I dont think its going to. The American Tree Farm System joined together with tax experts from the US Forest Service to provide webinars that will assist our Tree Farmers as they complete their 2011 taxes.

You simply subtract the amounts spent from your farms taxable income in the year the costs were incurred. Follow the IRS code Section 631 because a Christmas tree farm is considered a business. When running a tree farm you most likely need to pay employees to help you manage it.

If the trees are greater than six years when harversted they are considered timber in the tax code. For 2019 farmers and small businesses could deduct up to 1020000 of the tax basis of certain business property or equipment placed into service that year. A real benefit to tree farmers is that they can deduct the first 10000 in costs per year for.

The good news is that since the PATH Act of 2015 most farming businesses with annual gross receipts of 26 million or less for the three preceding tax years are not subject to the uniform capitalization rules.

Australia S Plantation Boom Has Gone Bust So Let S Make Them Carbon Farms

Https Www Ioof Com Au Essential Taxguide

The Cycle Of Food Fire Agriculture S Contribution To Wildfires

Take Advantage Of Water Facility Tax Deductions Pioneer Water Tanks Large Steel Rainwater Tanks For The Home Farm Cattle Growers Commercial Applications

Is Your Farm A Hobby Or A Business Mgi Australasia

How To Determine If You Re A Farmer For Tax Purposes

10 Tips To Start A Christmas Tree Farm To Make Money Pt Money

Tax Breaks For Small Farms And Agribusiness In California

Read Our Australian Farmer Tax Guide To Learn About Your Tax Obligations

Hobby Farm Tax Deductions And Business Structures In Australia

4 Ways To Start A Tree Farm Wikihow

Wholesale Plant Nursery Melbourne Wholesale Trees Plants And Shrubs

Tax Deductions For Landcare Riparian And Similar Expenses For Primary Producers Rivers Of Carbon

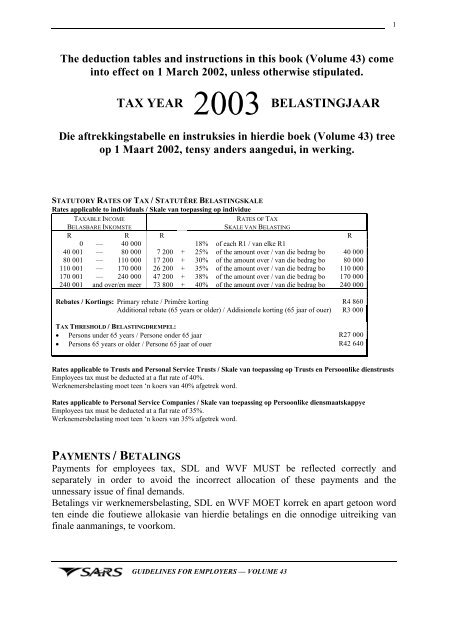

Sars Employee Tax Deductions Guidelines Workinfo Com

34 Tips On Small Business Tax Deductions And What To Claim

Take Advantage Of Water Facility Tax Deductions Pioneer Water Tanks Large Steel Rainwater Tanks For The Home Farm Cattle Growers Commercial Applications

How To Use A Small Farm For Tax Write Offs Small Farm Tax Write Offs Farm Business

Tax Deductions For Landcare Riparian And Similar Expenses For Primary Producers Rivers Of Carbon

Post a Comment for "Tree Farm Tax Deductions"